Latest from Plant Operations

2015 Business Outlook: Reviewing, Evaluating, and Setting Expectations

If the outlook for manufacturing is positive for manufacturing generally, is it also positive for manufacturing’s core elements — like forging?

Understanding the forging industry requires a closer appreciation of the businesses that perform the forging: Each September, FORGING initiates a survey of readers, principally to gather their understanding of the business climate in the industry, illuminating the conditions they have experiences during the current year and determining their expectations for the year ahead.

This is the second of a series: Read part 1, FORGING’s 2015 Business Outlook Survey

Read part 3: "Planning, Investing, and Developing"

The FORGING Business Outlook Survey for 2015 was conducted by email over six weeks during September and October among readers we identified by our circulation data as executives and managers in North America’s forging industry. The data we draw from their responses presents a reliable impression of circumstances in the forging industry in 2014, and the respondents’ expectations for business conditions in 2014.

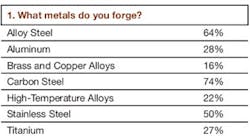

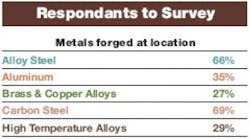

Our respondents represent the diversity of interests and experience within North American forging. They are the producers of all major types of metal and alloys— see Chart 1 — and their operations suggest a realistic balance of plant or operations sizes — see Chart 2 — from less than 20 workers to 250 or more.

Importantly, the respondents’ operations represent the full range of forging process activity — see Chart 3 — including many working with multiple process capabilities.

Furthermore, during 2014 these respondents’ operations have engaged across all levels of business — see Chart 4 — from less than $1 million to more than $100 million in net revenues.

Digging into their 2014 activities — see Chart 5 — we learn that more than 64% of respondents will finish the current year with a higher volume of business than they achieved in the previous year. Only a bit more than 7% of respondents revealed that the current year will show a decline in business versus 2013, while more than 28% expect that the results will be “about the same” as in 2013.

We sought more insight on this point from readers and asked them to estimated the percentage of the change. Among those indicating improved business activity during 2014 — see Chart 6 — 19.4% indicate the improvement will be in the range of 2-9%; 44% report the improvement will be in the 10-15% range; 25% of these respondents predict a 20-35% improvement; and 2.78% are expecting an improvement of 50% over last year’s results.

On the opposite side, and representing a much smaller portion of respondents (i.e. forgers expecting diminished results in 2014) — see Chart 7 — 50% estimated that decline to be -1 to -15%, 16.7% estimated it at -20%, and 16.7% estimated it at -30%.

We took the same approach to our respondents’ forecast for 2015 business activity. Among all respondents — see Chart 8 — 58.5% indicate that 2015 will deliver an increase in business volume for their operations, versus 2014; and 39.6% indicate the coming year will have results that are “about the same” as the current year. Just 1.9% of respondents expect next year’s results to fall behind the current year’s results.

Separating the responses among the positive and negative outlook for 2015 results — see Chart 9 — we learn that 34.6% anticipate an improvement of less than 10% over this year’s volumes; a like number, 34.6%, forecast improvements of 10-19% in 2015; 30.8% expect improvements of 20-30%; and 3.9% anticipate an improvement of 50% over the current year’s volumes.

The respondents with declining expectations for 2015 are far fewer in number — see Chart 10 — but among these respondents only we learn that roughly 60% expect an outcome of -1 to -10% versus the current year’s result; 20% predict results that are -10% versus the current year; and another 20% forecast a decline of -15% versus the 2014 volume.

To frame all this insight, we asked respondents to gauge the volume of the current year’s forging activity in terms of capacity utilization — see Chart 11 — and learned that 15.8% of respondents have operated at 20-40% of capacity during 2014, and a like number, 15.8%, have operated at 50-60% capacity; 21.05% have operated at 65-75% of capacity; 31.6% have operated at 80-90% of capacity; and 15.8% reported they have operated at 100% or more of their installed capacity during 2014.

Forging, like most manufacturing industries, operates in conditions set by global supply and demand conditions, and so we asked respondents to characterize the effect of imported forged products on their operations’ activity during 2014 — see Chart 12. Significantly, more than 30% have detected no effect on their business due to forging imports; though 37.5% of respondents sense an increasing threat to their performance, and just 12.5% detect a diminishing threat to their performance from imported forgings. Contrarily, 19.6% report their own operations are becoming more competitive as exporters of forged products.

This represents a quantitative evaluation of FORGING readers’ circumstances during 2014, and their expectations for 2015. How those circumstances will shape their capital and strategic planning for 2015 is the subject of the next installment in this series.

Read the third and final installment of this series on the 2015 FORGING Business Outlook survey to learn how forgers plan to invest and expand in 2015.