Everyone wants to know the future, and never more so than in uncertain times. For everyone in manufacturing the past year has been another test of endurance: how long can we put up with the uncertainty?

We’re seeking some insight with our annual Business Outlook Survey, which we present every year in an effort to interpret the past and illuminate the future. Specifically, we aim to document the impressions of informed readers regarding the forging industry’s business conditions during the preceding year, and to gauge their expectations for the year to come.

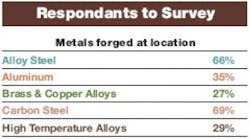

FORGING magazine conducts the survey each fall among executives, managers, and operators in North America’s forging industry — identified and authenticated by our circulation data. The 2011 Business Outlook Survey was conducted by e-mail during September and October, and the results represent a reliable cross-section of interests and perspectives, in terms of the materials the respondents’ forge, the size of their operations (measured by employment totals), and the types of forging operations performed at their plants.

Whatever conclusions may be drawn from the results, one detail indicates improving conditions in the forging industry: the annual survey’s response rate has increased more than 76% since was conducted last, in 2009 — an impressive feat in view of the fact that the survey conducted one year ago beat all prior versions. The indications may not be entirely rosy, but the fact that nearly 150 forging professionals are active, engaged, and willing to participate in an opinion poll, demonstrates the vitality of the market.

Perhaps the essential question among the 25 we ask each year to this influential segment of the forging industry is this: Will business improve next year? That’s not the exact phrasing, but that is what we’re hoping to learn. Apart from the determining factors, apart from the variables, apart from the qualifications, we want to know if things are getting better.

The conclusion among our respondents is “uncertain”; they are evenly split, to the extent that 50% tell us their business will improve, and 50% conclude that either it will stay the same as it has been in 2010 or grow worse. So, it’s clear we need further analysis.

Shipments, in dollars and tons

To begin, we asked our respondents to estimate the total value of their 2010 shipments (see above). The largest percentage of them, 19%, pegged the value between $20 million and $50 million, a wide range to be sure but an encouraging indicator of today’s business conditions. Supporting such optimism are the results showing 13% will register shipments valued at $50-100 million, and 14% will post shipments valued at more than $100 million. In short, 46% of all respondents will have 2010 shipments valued at more than $20 million.

Given the demographic profile of the 2010 survey respondents, such results are a positive statement about demand for forged products in 2010. And, this sets the baseline for looking forward to 2011.

We asked the respondents to estimate whether their operations’ 2011 shipments would be larger, in terms of tonnage than they have been in 2010. While the result is not conclusive, the fact that 49% of all respondents expect to increase their shipment volumes from this year to next is a hopeful circumstance. That only 7% see the likelihood of shipments declining also is encouraging.

The difficult reading of this data lies with the 44% of respondents who see 2011 shipment volumes remaining mostly the same as in 2010. Are they just hanging on? Are they operating at their maximum capability? This is emblematic of the uncertainty that surrounds most areas of manufacturing as 2011 arrives.

Importing issues

What is not uncertain is the role of imported forged products on domestic operations. Because of the essential nature of forgings to so many high-value manufactured products, the forging market has been on a faster route to globalization than many other industries of similar scale. But, do forging imports have a serious affect on business?

We asked our survey respondents to gauge the impact of imported forgings on their business in 2010, and 43% of them indicated there is no affect. However, nearly one third of all respondents, 32%, told us that imports are having an increasing affect on their business, and 13% indicated that imports are having less of an affect than in the past. Most encouraging of all, 12% of respondents confirmed that their operations are increasing their own exports.

In 2009, when we asked respondents the same questions about imports affecting their business, a smaller percentage indicated there had been no affect (35%), and a larger percentage (36%) reported that imports were having an increasing affect. And, a smaller percentage also said that imports were having less affect on their business than in the past, so that in every respect it must be concluded that imports are having less impact on the success of the domestic forging industry in 2010 than they had in 2009. To seal the deal, a larger percentage of respondents in 2010 confirmed success at increasing their forging exports.

Present and future

So then, what are the major problems affecting the forging business in 2010? We invited respondents to identify more than one issue, in order to get a broader perspective on these factors, and yet a decided majority of all responses selected “Raw material lead-time” as the most significant problem (see p.18). A related issue, “Higher raw materials costs,” came in second.

Following then, in order of response frequency, were “Energy costs,” “Medical/insurance costs,” “Lack of orders,” “On-time delivery of forgings,” “Raw material quality,” and then “Foreign competition.” “Workers compensation costs,” and a tie between “Higher labor costs,” and “OSHA requirements” completed the top 10 problem areas for forgers in 2010.

Looking forward, our respondents see “Higher raw materials costs” becoming the major problem for their businesses in 2011, a view shared by 50% of all respondents. That concern is followed closely by “Energy costs” and “Raw material lead-time.” Somewhat behind these three are “Medical/insurance costs,” “Lack of orders,” “EPA requirements” and “On-time delivery of forgings” (tie), “Foreign competition,” “Higher labor costs,” and in a three-way tie, “ “Capital availability,” “OSHA requirements,” and “Workers compensation.”

Where is all the money going

Not all of forgers’ attention for 2011 is focused on problems: Capital improvement programs are very much in their sights, as 66% of all respondents indicated some major spending programs on their 2011 schedules: New plant, 3%; Plant expansion, 7%; and New equipment, 56%. As compared with 2010, 61% of respondents predict their 2011 capital spending will be “about the same” as it has been in 2010, while 41% will be increasing their outlays and 14% will be decreasing their expenditures.

Topping the list for forgers’ spending plans is “Forging machine rebuild and/or controls modernization,” a choice made by 41% of all respondents. Behind it, popular with 33% of respondents, is “Forge furnaces/billet-bar heaters,” and then “Heat treating equipment,” chosen by 33% of respondents. “Machine tools,” “Training/education,” “New forging machinery,” “Lift trucks/loaders,” and “Simulation software/hardware,” followed. The list of forgers’ top 10 capital improvements for 2010 is completed by “Cutoff equipment” and “Die sinking equipment.”

Of course, capital spending requires a budget. Our survey respondents indicate that forgers’ 2011 borrowing plans will be reasonably modest: 40% of all respondents indicate their operations currently carry no debt, and 18% intend to pursue plans to retire debt during the coming year. The remaining 42% indicate their operations will be maintaining debt at levels about equal to 2010.

Looking forward is a challenge to human nature and the end of each year imposes that challenge on businesses — and the results bring consequences. Information helps to clarify the choices we must make, and by examining the factors shaping the choices our readers face we aim to improve their understanding of the forging industry and build their confidence about the challenges ahead.