Is it possible that everyone else is wrong? Respondents to FORGING's annual Business Outlook Survey are takinga decidedly positive approach to the arrival of a new year, or at least a calm assurance. A majority of respondents expect their total forging shipments to rise in 2013, or to remain mostly even, year-on-year; less than 20% expect their deliveries to decrease over the current year's results.

It's an outlook that is confirmed by an IMS Research report published this month forecasting industrial capital spending will continue to increase, and when the results are in for 2012 it will have risen 6.8% over the 2011 level. That study also predicts that total industrial capital spending in the Americas will pass $1 trillion by 2015: oil-and-gas is the sector drawing the most investment, more then one-third of all spending, IMS reported.

But that is an analysis that seems to filter out some external factors: the same source offers a more sober reading of recent manufacturing activity, as documented in the widely referenced Institute for Supply Management's purchasing managers' index (PMI) for manufacturing. There, IMS is concluding that although manufacturing volumes are rising slightly as 2012 closes, new orders have been "roughly flat, and unfilled orders continued to fall very rapidly.

"Continued production growth needs better orders," the IMS analysis stated, "The drag from weak export orders is being compounded by the uncertainty over the ‘fiscal cliff,' which is paralyzing domestic decision-making."

Of course, … the fiscal cliff. It's phenomena of policy that has infested productivity, as investors prepare themselves to take a recessionary jolt they expect once income tax rates spike and automatic federal spending cuts take effect, all in the absence of an agreement on a new federal budget as 2013 draws near. IMS calls it "an eminently fixable problem," but one with no resolution in sight.

Is this plausible? Would a drop off the cliff be enough snuff industrial demand that otherwise is apparently quite healthy? And what of the global economy? While there have been doubts brewing all year long over the sustainability of China's economic growth, IMS has found improvement in that nation's PMI, indicating stability in the near-term forecast. But, Europe remains strapped by the insolvency crises in several EU member states, which has been inhibiting regional investment and expansion through most of 2012 — and reminding the rest of us of the contagious damage that can be done even to normally steady economic systems once public debt becomes unsustainable.

It is in this atmosphere that forgers' view of economic conditions stands out. Forgings are among the handful of essential products for an industrial economy — as critical protein or vitamins are for healthy nutrition. Without forgings, an economy cannot grow.

Business Outlook Survey

The FORGING Business Outlook Survey for 2013 was conducted over six weeks during September and October among readers we have identified by our circulation data as executives and managers in North America's forging industry. The data we draw from their responses presents a reliable impression of circumstances in the forging industry in 2012, and the respondents' expectations for business in 2013.

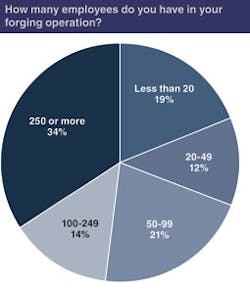

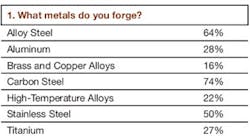

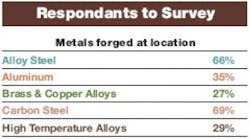

The respondents also represent the diversity of interests and experience within North American forging. All major metal categories are represented, and their operations suggest a realistic balance of plant or operation sizes, from less than 20 workers to 250 or more.

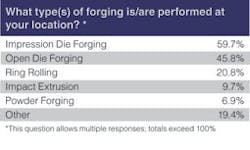

Most persuasive, our respondents are active in the full spectrum of forging processes: impression die forging, 59.7%; open-die forging, 45.8%; ring rolling, 20.8%; impact extrusion, 9.7%; and even powder forging, 6.9%. Almost one fifth (19.4%) are engaged in some other processes as well (the total exceeds 100% because numerous respondents perform multiple types of forging.)

Also instructive of our respondents' views is the scale of their businesses: just under 10% are involved in businesses that will ship less than $1 million worth of forged products this year; 23.9% of respondents will ship products with total value ranging from $1 million to $5 million; 8.5% will ship in the $5-10 million range; 11.3% will ship $10-20 million; 9.9% will do $20-50 million of business this year; and 16.9% will ship $50-100 million of forged products. Finally, nearly 20% of our respondents are engaged in businesses estimated to ship more than $100 million of forgings in 2012.

Shipping forecast

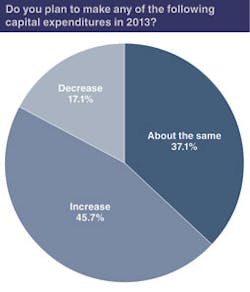

That framework provides the hook to examine the respondents' forecast for business conditions in 2013. A plurality of them, 45.7% believe their total shipments for 2013 will exceed the final results of the current year. A further 37.1% believe the 2013 shipments will be essentially the same as this year, leaving just 17.1% to conclude activity will be declining next year.

Within these differences are some notable variations. Respondents that forge brass and copper alloys are most likely to predict increasing sales, while forgers of stainless steel are least likely to predict an increase. The highest share of respondents predicting declining sales is among the alloy steel forgers, though that group overall predicts rising volumes ahead.

A sizeable number of smaller forging plants, those with fewer than 20 employees, believe their 2013 shipments will be about the same as they are this year, while only 21% of these respondents see increased activity ahead.

The expectations flip for forgers in the next largest plant-size segment: 77% of forgers with 20-49 employees anticipate rising shipment volumes. Proceeding up the scale of plant size (50-99 employees) the outlook draws more even between those expecting little change (46%) and those expecting an increase (40%); and the optimism rises again for respondents with 100-249 employees, where 44% see increases to come and 33% see little change. Then, respondents from the largest operations (250 or more workers) confirm by 52% (increase) to 30% (about the same) the trend of forecasting higher shipment volumes.

At the same time, the outlook for a decrease in 2013 shipment volumes remains a consistently small percentage of respondents across all plant sizes.

Discussions of shipments invariably lead to issues of global trade, and over several years we have asked respondents to the FORGING Business Outlook survey to gauge the impact of foreign imports on their business. During 2012, 42.9% of our respondents indicated that imports have had no effect on their business, but 24.3% respond that imports are an increasing factor. Smaller numbers (17.1%) conclude that competition from imports is decreasing in significance, and just a bit fewer (15.1%) responded that their own export business is growing.

Capital ideas

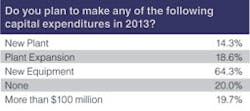

No inquiry measures manufacturers' confidence like capital spending. An impressive 64% of all survey respondents confirm plans to invest in new forging equipment during 2013, and 18.6% of respondents will expand their current plant facilities during that time. Also notable is that 14.3% of the respondents have capital expansion plans that include new plant construction. Still, 20% of survey respondents have no plans in plant or equipment during 2013.

In closer detail, the increases in capital investments by survey respondents are more likely to occur among larger forging operations, more specifically among those employing 100-249 or 250 or more workers. Smaller-scale plants are more decisive in their plan to keep investments even with 2012 levels.

Those investment plans will not necessarily represent a change in capital spending volume. Close to 50% of all respondents indicate their capital spending levels will remain the same, and nearly 19% indicate they will reduce capital spending total in 2013. An even one-third of all respondents plan to increase capital spending totals.

For the most part (59.4%), those respondents who plan capital investments during 2013 do not plan to exceed their current debt levels, and close to one-third of respondents indicate they are carrying no for capital investments.

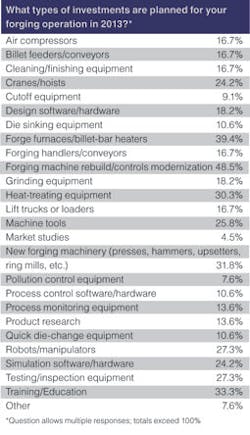

A near majority (48.5%) of all respondents identified "Forging Machine Rebuilds or Controls Modernization" among their investment choices for 2013. No other category drew nearly as much attention. Next in popularity are investments in "Forge Furnaces/Billet-Bar Heaters," which will involve almost 40% of all respondents' investments. "Employee Training/Education" (33.3%); "New Forging Machines (presses, hammers, upsetters, ring mills, etc.", 31.8%); and "Heat Treating Equipment" (30.3%) also drew sizable levels of interest among respondents.

Strategic planning

Forgers' positive outlook about 2013 prospects may be confirmed by their forecasts for shipments or their spending plans, but it does not preclude concerns about obstacles or challenges, and many problems that emerged in 2012 are expected to continue to be important factors in the forging industry's activities.

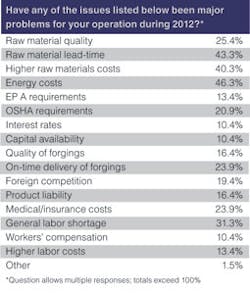

During 2012 the prevailing challenge for survey respondents has been "Energy Costs," as 46.3% of them cited it as a major problem for their operations. "Raw Material Lead Time" (43.3%) and "Higher Raw Material Costs" (40.3%) are formidable concerns, too. Problems stemming from a "General Labor Shortage" affected 31.3% of respondents.

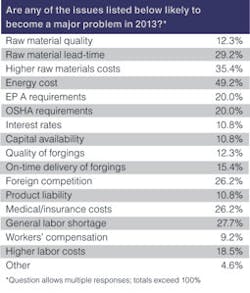

In their outlook to 2013, respondents see a similar array of problems ahead. In fact, "Energy Costs" increases as a concern to 49.2% of all respondents, while "Higher Raw Material Costs" slips down to 35.4% and "Raw Material Lead Time" falls to 29.2%. The worries about a "General Labor Shortage" concern 27.7% of respondents, looking forward.

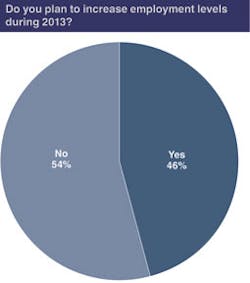

One factor that appears to incorporate numerous details about the success or progress of a forging business is employment: 54.4% survey respondents indicate they will not be increasing employment levels at their operations during 2013, and 45.6% will be hiring more workers.

The state of the forging industry is an ongoing concern, regardless of the year. We asked our readers to identify their greatest concern about the future development of forging as an industry, and the dominating issue for respondents is "Lack of a Qualified Workforce" (46.3%), and only a concern for programs to "Grow the Incoming Workforce" (19.4%) ranks with any considerable total as a secondary concern.

To address this issue, two recommendations stand out among our respondents: "Increased Involvement by Forging Companies with Trade Associations, Colleges" (39.7%) and "Additional Training Programs (college, trade school)" (36.8%), suggesting a broad concern about opportunities for technical understanding and professional development.

The results of our 2013 FORGING Outlook Survey reveal a highly engaged and informed industry – one that is honest about its problems and shortcomings, but nevertheless confident about its strengths and opportunities. They know what they are doing and are clear-eyed what they face in 2013. The world may be spinning wildly, but forgers are moving forward with assurance.