First, the good news: domestic forgers of all sizes and varieties are overwhelmingly optimistic about their business prospects in 2012, and they’re making plans to take advantage of their anticipated success. Given all that’s happening in the world, it’s important to emphasize this point.

As 2011 recedes there is plenty about which to be guarded in our optimism, or confused about the economic future. Credible forecasts by economists and financial institutions contemplate an extraordinary string of calamities emerging from bewildering circumstances in the Europe economy, everything from financial defaults by EU member countries to a complete collapse of the Union and dissolution of the Euro currency. At the same time, the long-steady Chinese economy suddenly seems vulnerable thanks to an overvalued housing market. And in the U.S. economy, debt, unemployment, and weak consumer activity continue to depress economic growth — the same triad of problems that have gripped the economy for more that three years. Businesses and individuals alike are eager for clarity, but almost nothing is clear.

It is clear, though, that domestic forgers are bullish on their prospects for 2012.

The FORGING Business Outlook Survey was conducted over six weeks during September and October among readers identified by circulation data as executives and managers in the North American forging industry. The resulting data is a reliable template of circumstances in the forging industry in 2011, and the respondents’ expectations for business in 2012.

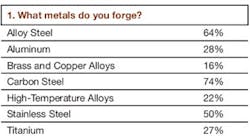

These respondents represent a diversity of interests and experiences, too: 73% produce carbon steel forgings and 64% forge alloy steel, while 49% produce stainless steel products (many operations produce forgings in more than one material, resulting in a distribution that exceeds 100%.) Aluminum forgings are produced by 27% of the respondents, and titanium products are forged by 26%, while high-temperature alloys are the output for 22%, and brass and copper alloys are produced by 16%.

Furthermore, 23% of the respondents represent forging operations that will ship more than $100 million worth of products during 2011, while 20% are affiliated with operations shipping $20 million to $50 million this year. Following these, 16% represent plants operating in the $10 million-$20 million range; 14% will ship less than $1 million in products this year; 10% will ship $1 million to $5 million of forgings; 9% will ship $5 million to $10 million of material; and 8% will have shipments in the range of $50 million to $100 million.

These are the forging professionals responsible for the positive outlook. Only 3% of all respondents expect poorer results next year than this year, and 53% see better business in 2012. The greatest percentage of optimism (65.4%) is found among producers of titanium forgings, followed by producers of high-temperature alloys forgings (59.1%) and alloy steel forgings (58.1%.)

While the total number of respondents who expect results to be poorer in 2012 than in 2011 is negligible, most of those respondents are identified as titanium forgers, too.

Building plans

We take capital investment as a statement of optimism, so the respondents’ spending plans of forgers is a reliable corroborator of their stated optimism. A not-insignificant 7% of respondents confirmed their 2012 capital investment plans include new plant construction, and 26% have facility expansions or additions scheduled. Most of this new construction is planned by carbon steel forging operations, while the expansion planning is more common among producers of high-temperature alloy and brass-and-copper alloy forgings.

The 2012 spending plans also will include new equipment purchases by 60% of the forgers responding to our survey, and the high percentages are well distributed among all categories and sizes of forgers.

It’s worth observing that the capital expenditures outlined for 2012 are not sudden expressions of confidence in the forging industry. Nearly half of all respondents, 47%, indicated that their 2012 investments will be equal or nearly equal to their 2011 investments, and only 12% indicated they will be reducing their investments next year; 41% intend to increase capital spending in 2012, which is good news from any perspective. Also note, nearly half of all respondents (46%) plan to proceed through the next year without increasing their debt levels, and 13% aim to retire debt in the year ahead. An encouraging number of respondents (41%) indicate their organizations are carrying no debt at this time.

Where does the money go?

How forgers will direct their capital investments in the coming year is a helpful indicator of their business conditions.

Because we invited respondents to identify multiple targets for their spending, the resulting data exceeds the number of respondents: 48% of all respondents have plans for new forge furnaces or billet/bar heating installations. In addition, 41% have identified forging machine rebuilds and/or machine controls modernization, and 29% will be adding new cranes or hoists. Another 29% plan heattreating equipment installations in the coming year. The obvious implication of these investment plans is that forgers need greater productivity in their operations, either in terms of product throughput or process reliability, or both.

A different, likely reading of these results is that forgers aim to increase the value of their finished products: in addition to plans for new heat-treating equipment (29%), new machine tools (33%) are identified among the top spending targets of respondents.

Other high-ranking categories for investments include process monitoring equipment, identified by 23% of respondents; robots and manipulators, 22%; testing/inspection equipment, 22%; new forging machinery (presses, hammers, etc.), 21%; and lift trucks/loaders, 21%.

Two categories of 2012 investments bear closer examination: forging simulation technology and training and education programs.

Simulation is the real thing

Forging simulation software has progressed at a remarkable rate in the past decade, and the developments are emerging more frequently now than at any time. It’s also a product category with a significant number of product developers and suppliers, which of course is an advantage to forgers themselves.

We have pol led readers to determine how widely forging simulation has been adopted over several years. The result for 2012 shows an all-time high of 48% of respondents confirming their use of simulation software. Among those users, 45% report the software is used as part of production process planning (reduce shop-floor trials, optimize processes); and 53% of respondents report they use simulation for that reason as well as to perform process analysis.

The respondents who do not use simulation software offer three primary reasons for this: 33% see no value for simulation in their operations; 23% report that the cost of the technology has prevented their commitment; and 15% have no one with the necessary experience to manage the simulation.

Other reasons offered for opting against forging simulation technology include “communication” and “accounting” concerns, as well as several who rely on 3D CAD programs to accomplish their design goals, and some who feel the available simulation programs are not optimized for their forging processes.

Training workers is a 2012 investment priority for 40% of the respondents, a number that reveals long-term planning as well as concern about organizational needs. It’s an indicator that amid the optimism forgers share about the near future of the business, there are challenges to continued success.

We asked readers to identify the leading problems for their organizations during 2011, and to list the challenges they expect to face in 2012. In these multiple choice questions, a 53% majority of all respondents reported that the cost of raw materials has been a challenge during the past year, and 49% added that raw material lead-times have been a problem for their operations.

Related to this problem in the production end of the business, 35% of respondents cited energy costs among the leading problems for forgers in 2011. But, an outstanding problem for forgers has been medical and insurance costs, an issue cited by 41% of respondents.

A range of problems filled the middle tier of problems forgers experienced during 2011: a general shortage of labor (28%); EPA requirements (23%); high labor costs (23%); and on-time delivery of finished forgings (22%.)

The respondents’ outlook for 2012 is for most of these conditions to continue: 53% cited raw material lead-times, making it their most common concern for 2012, and 47% added that higher raw-material costs will be a problem for them in the coming months. Nor do our respondents expect medical and insurance costs to become more manageable in the next year: 38% listed it among the issues likely to challenge their business in the year ahead.

Knowing that our respondents must manage for the long term as well as the year ahead, we asked them to evaluate the training and staffing problem that so many (40%) of respondents indicate merits investment priority in 2012. A near majority, 47% of respondents indicated to us that the availability of qualified workers would have the greatest impact on the industry, and 27% sense that a lack of educational and training opportunities is having a negative effect.

Probing this subject a bit further, we found that 42% of our respondents believe additional forging educational and/or training programs would be most effective at overcoming this problem, and a similar number (41%) offered that greater involvement by producer companies and trade associations with educational institutions would address the matter effectively.

Reason to believe

So what keeps forgers in our survey optimistic about the future amid the confusion of global finance, government policies, and manufacturing challenges? In short, it’s their confidence in their own organizations. We asked the respondents to identify the consumer markets that offer the most promise for their forging companies, and the results show not only their confidence but also the diversity of programs that forgers have developed to gain their share of the industrial economy. Just 15% of respondents cited automotive component markets other than fuel-efficient engines as an anchor for their future success, and adding engine programs raises this portion of respondents to just 18%. Plainly, forgers are seeing their future success beyond the automotive industry.

More than a fifth (22%) of the respondents place their confidence in infrastructure and construction markets (e.g., mining, off-road equipment, etc.), and 20% see their success in producing aircraft and aerospace forgings. Energy markets (alternative energy, nuclear energy) also earn recognition among our respondents.

The summary view is that forgers we surveyed are not immune to the demands of a global market, nor of their own shortcomings and challenges. But, the various obstacles to success in manufacturing are nothing new to them, and having been faced with the pressures of competition they feel ready for the challenge.