There was trouble from the beginning, and even before that. Words may be insufficient to describe the scope of the economic problems that started in the fall of 2008. It was called historic, catastrophic, calamitous, devastating, disastrous, ruinous, and so much more. How could anything top that? In the experience of forgers and manufacturers, 2009 came close enough.

The global financial collapse that continued through the current year, was notable for a less obvious reason: it was globalized. It was felt everywhere, touching every financial sector, and nearly every business organization at its workers.

We can say we might have seen it coming. The decade preceding this cr isis saw its build-up in all the obvious ways: over-extension of credit, overleveraging of assets, overvaluing of currency, under-reporting of debt, and so on. But, in manufacturing industries (among others) the decade preceding the decline was the decade of globalization. Notably, that period saw the globalization of information, which precipitated the globalization of finance.

Most domestic manufacturers revile globalization, but the wider world generally credits it as a force for economic growth. Manufacturers and thei r al l ies have never been able to implement a coherent policy for blunting globalization’s effects without squashing demand for manufactured goods. Then, in 2008-2009, when globalized markets reversed from growth to decline, their point was made in the worst way possible.

Forging in 2009

The big picture of 2009 is clear, but is it supported by facts? Each fall, FORGING surveys executives, managers, and operators in North America’s forging industry to document their impressions of the preceding year and to gauge their expectations for the year to come. Notwithstanding the anxious circumstances prevailing in 2009, both the total number of responses and the response rate were stronger than in any prior year’s Outlook survey.

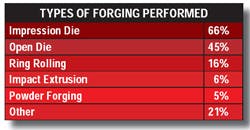

This year’s respondents represent the range of operations in the domestic forging market: a reliable distribution of plant sizes (less than 20 workers, 20-49 workers, 50-99 workers, 100-249 workers, and over 250 workers); forging processes (impression die, open die, ring rolling, impact extrusion, powder forging, and others); and metals forged (alloy steel, aluminum, brass and copper alloys, carbon steel, high-temp alloys, stainless, and titanium).

What has it meant to be a forger in 2009? Our respondents indicated that the total value of their 2009 shipments is distributed fairly evenly, from less than $1 million to more than $100 million. And, to no surprise the value of shipments has declined in each segment versus the 2008 result. Most respondents indicate their shipments’ values will fall in the range from $20-50 million this year.

However, there are some notable observations in the comparison to 2008 figures. The sharpest decline will be seen in shipments valued from $1 million to $5 million; in 2008 this segment accounted for 27% of all forging shipments; in 2009, it will be 15%. That change, they indicate, will mean that most 2010 shipments will occur among those valued from $50 million to $100 million: that segment will increase from 4% of all shipments in 2008 to 15% of all shipments in 2009. Though total forging shipments are down in value for 2009 versus 2008, companies operating in that $50-100-million range manage to hold enough business to dominate activity in the market segment.

Among our respondents, total forging shipments are seen rising among 11%, and staying about even with 2008 among 20%. However, 69% of respondents report 2009 shipments will decline.

Better, among our respondents the forecast for 2010 shipments is for business activity to increase (49%) or remain about the same (41%) as 2009; just 10% of our respondents see their business activity declining further in 2010.

Capital spending is a general indicator of business optimism, but if there is optimism among forgers it is tempered. Nearly half of the respondents (47%) project their capital spending will remain even with 2009 capital spending; and, just 31% intend to invest more next year than this year. More than one-fifth of respondents intend to reduce investments.

Pushed for more detail, 40% of respondents have no investment plans scheduled for 2010, but 52% have budgeted new equipment purchases, and a further 16% have new construction in mind.

How might they be investing in the coming year? New or improved forging process machinery and controls lead our respondents’ wish lists for the coming year: 47% of all indicated as much. Other areas of declared interest are heating equipment for billets or bars (34% of all respondents); lift trucks and loaders, 25%; heat-treating equipment (19%) and machine tools (19%). A telling response reveals that 33% of all respondents intend to invest in training and/or education programs for their workforce in 2010.

What does it mean to be a forger facing 2010? Among our respondents the mood is cautious, but not dire. There is a willingness to invest in business needs, even while there is an acknowledgement of the challenges facing forgers. Their estimation of the problems facing the industry bear similarity to comparable responses in 2008: in each year they listed “Lack of Orders,” “Higher Raw Material Costs,” and “Energy Costs” among their top concerns.

But, Lack of Orders has fallen significantly among the concerns of this year’s respondents — from first in 2008 to third ranking in 2009. The rise in importance for Higher Raw Material Costs and Energy Costs indicates a general recognition of 2009’s broader financial market developments, and how globalization remains the defining factor for successful industrial operations.

2010’s Big Picture

If these responses are indicative of the entire forging market, then it’s reasonable to conclude the industry is well informed about the challenges of global manufacturing. Banks remain tentative about lending and private capital is more cautious than ever, so money remains scarce for new projects or even ongoing operations. Consumer and industrial demand is still barely palpable, and global competition is as strong as ever.

But, according to Deloitte & Touche L.L.P.’s Tim Hanley there are broader issues for forger to address, or to endure:

• Federal spending was intended to liquidate capital markets and stimulate industrial spending, but 10 months into the program it’s apparent that the government’s efforts are disguising the true level of demand, so manufacturers cannot commit to capital spending plans.

• Manufacturing supply chains and manufacturers’ “footprints” have become confused and less reliable thanks to geographic shifts and uncertain consumer demand.

• Commodity and energy prices are volatile, so manufacturers cannot forecast their needs and are fearful of future spikes when/if the global economy strengthens. • Persistently weak and uncertain economic recovery means that manufacturers must continue to reduce structural costs, straining productivity.

• Enhanced global competition and weakened global demand limits producers’ ability to pass costs to customers.

• A shrinking pool of affordable and capable workers, engineers, and executives complicates long-range planning and growth potential.

These forecasts are mirrored in our respondents’ estimations. But, the lesson of 2009, the insight to carry in to 2010, is this: The globalized economy is an established fact, effective in its weakness as well as strengths. Moreover, the actions aimed at “fixing” this global economy are so far incapable of arresting a crisis, meaning that global competitiveness will be a more influential standard for all manufacturing concerns.

| “IN THEIR OWN WORDS” “The foundation of this industry is suffering. Many employment-seeking engineers look at forging as dirty, hot work with little or no compensation or chance for growth.” … “Utility costs have increased in 2009 and are likely to increase in 2010 … .” “The forging industry is very slow at this time, mainly due to the economy, and lack of orders.” … “Market overvalued … Toxic assets not fully reported to investors. … Increased in ation to come, due to printing of money. … Increased cost of everything in the future.”… “Customers want lowest price, and pieces yesterday. Almost all orders have super fast lead-time which can lead to problems when dates are not met.” … “Quick die changes will receive more attention as forging lot-sizes will become smaller next year.” … “We have had a difficult year with the economic downturn, especially in the automotive industry. We have seen an improvement in the automotive industry and hope that will continue. We are also concerned about the future because of the impending legislation.”… “Consumers are the engines that drives the economy. When consumers get nervous, they slow their spending and the economy suffers. Nothing new in those statements but we tend to make things worse for consumers by telling them how bad things are going to get.” |