With 1.4 million feet of exhibit space, there was almost too much to take in at the International Manufacturing Technology Show (IMTS) in Chicago last month. By the end of the industrial Iditarod, after walking and talking nonstop for three straight days, I was over it. Bored of all the amazing tech. Sick of navigating mobs. And dead tired.

There was one type of technology that I didn’t get enough of, and if I had any sort of mechatronic acumen, would have retooled to do my job for me: Mobile robotics.

I first started covering these plucky go-getters exactly three years ago this month, with the then still-unlaunched KUKA Mobile Robotics iiwa. It’s a waist-high autonomous cart attached to a seven-axis robot. KUKA’s vast orange emporium at the tradeshow featured one circling a car chassis, its arm tooling closing in at certain spots to simulate an inspection. The chassis was on top of a flatter, slimmer platform, the KMR 1500.

The new omni-directional machine’s payload is a whopping 1,500 kg, or 3,300 lb. It measures 2,000 mm x 800 mm, with a height of 470 mm. An optional lift table adds an additional 200 mm to place it at a more ergonomic height. Using the SLAM (Simultaneous Localization and Mapping) method, based off data from safety laser scanners and wheel sensors, the KMR 1500 can haul an entire car throughout a facility without fixed infrastructure, stopping at predetermined points for the next step in the manufacturing process.

This robot-on-robot concept provides a great visual for where mobile robotics are headed, and could someday completely alter how an automotive OEM thinks about factory design in the future. You could also imagine how useful this nomadic production line could have served Tesla when they had to build Model 3’s in their Fremont facility parking lot this past summer.

But what about today? What mobile robotic options are out there that any manufacturer or logistics operation use for their material handling needs?

The answer is plenty.

At their core, autonomous mobile robots aren’t radically different than the typical AGVs that have been rolling along factory floors since the 1950s. Four wheels. Low to the ground. Carry things from place to place. Of course, they are much smarter and not confined to magnetic tape lines. However, as their intelligence has evolved, they have become inextricably stuck to the digital transformation the industry is undergoing. Every second their sensors collect more data—information that can be used to optimize routes and track materials. And unlike me, they won’t get bored or tired. And while towards the end, I became more haphazard in avoiding other people in the crowds, probably bumping into a few to squeeze by to make an interview, their sensors and programming ensure there are no unintended collisions.

This, combined with advances in self-driving tech over the last decade, has created the perfect environment for a steady parade of innovative mobile robotics all jockeying to lead the pack, all trying to find their niche, all trying to usurp the status quo.

Fork to Table

When the first industrial robots entered the production space, people started dying in horrific new ways. The solution was to cage the beasts, which wasn’t able to totally offset humans’ propensity to find needless ways to die, but overall effective. The 21st century answer was to create collaborative robots that can safely work alongside people due to softer, lighter bodies and a bevy of sensors to keep them true to Asimov’s rules.

Meanwhile, forklifts predate industrial robots by more than half a century, and as of 2007 OSHA calculated they were the cause of 85 fatalities and 34,900 serious injuries per year. More widely used by an inordinate number and inoperable without human interaction, they remain a necessary risk. The idea of more collaborative mobile robots out in the field could change that.

“Our guess is we’ll see a boom in the coming years,” offered Thomas Visti, CEO of Mobile Industrial Robots, who I met at IMTS.

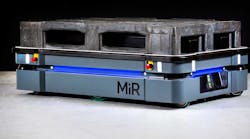

MiR, which has seen 140% growth this year (300% in 2017), will likely be at the forefront of this boom with the MiR500, designed specifically to replace lift trucks across a range of industries. The Danish company debuted it for American audiences in Chicago, though it first appeared at Automatica 2018. It became available this month.

Unlike the earlier, smaller MiR100 and MiR200 (a 2018 NED Innovation Award winner), this bigger version (1350 x 920 mm) can handle pallets—both European and 40 x 48 in.—with ease. With all three, the number designation indicates payload in kilograms, which for the MiR500 equals 1,100 lb. An additional lifting device, depending on the type of pallet, can be attached to the top of its platform to raise or lower the pallets after it slides in or out of the specially designed rack, basically two opposing metal brackets spaced slightly wider than the robot.

It was created based on demand from customers with large parts.

“From a safety point of view, [manufacturers] don’t want to drive a forklift, so they’re moving to autonomous products that are more collaborative,” says Visti, who formerly worked with cobot creator Universal Robots.

And by the looks of its sturdy, compact frame, it could certainly challenge forklifts

“The MiR500 is an extremely robust robot, with an exterior that can withstand dropped cargo and can navigate up and down ramps and even through shallow water puddles,” Visti says.

He adds that it’s extremely user-friendly and can be controlled and programmed without any prior experience using a smart device. The MiR500 uses the same software as the previous models, relying on two 3D cameras that can detect objects 11 feet away, and a SICK Microscan3 safety laser scanner system for 360-deg. coverage.

“It drives safely between people that are moving and other moving machines,” says Jakob Klokker, project assistant at the Kverneland Group, an agricultural machine maker who has already tested the MiR500 as the material handling solution for taking pieces from one process cell to another.

He agrees it is user-friendly.

“We can use the map in the robot interface to easily plan where we want it to drive and where we don’t want it to drive, so we can define the optimal routes for us,” Klokker says.

As a one-off, the robot uses its own internal WiFi, but a fleet requires the facility to have WiFi.

“Basically, there are not many other limitations of the MiR500, and as a customer you can set the expectations high,” Visti says.

It appears they have.

“This is a dream come true for us,” says Patrick Garin, president, Cabka North America. “We are one of the largest plastic pallets manufactures in the world and now have a collaborative robot that can perform multiple tasks. We have big plans with this MiR500, from stacking our pallets coming out of our production lines on the MiR500 to preparing outbound deliveries at night when there is no activity in the warehouse.”

Visti says the that the buy-in from several multinational corporations, “equaling hundreds of installations,” for MiR’s range of mobile robots, indicates one thing.

“They want to have all forklifts out,” he says. “The business case is there, the technology is there and the customers are ready to test it and install it.”

He believes overall that the wider adoption of mobile robots could noticeably affect forklift injury and death stats in the next two or three years.

The CEO was hesitant to speculate on a fixed ROI this early, but from a holistic perspective, says it positively impacts both production and payroll.

“There is a low total cost of ownership due to easy implementation and the natural optimizations, such as optimized logistics workflows, which frees staff resources so customers can increase production and reduce costs,” Visti says.

Move it or Lose It

A few hours after speaking with Visti, I sat down with Jeff Christensen, VP of product at Seegrid, a Pittsburgh manufacturer of self-driving pallet trucks with deep ties to Carnegie Mellon. It’s their chief scientist, Hans Moravec, who worked out stereoscopic vision guidance for autonomous vehicles. The company calls their material handlers VGVs (Vision Guided Vehicles).

Seegrid’s product line, which was expanded with the GT10 Series 6 Plus at IMTS, uses five pairs of cameras that operate like human’s stereoscopic vision, so they can perceive depth. The GT10 also has back-facing cameras to sense when it is hitching to a cart. Their form factor resembles a typical forklift but without the fork. They still have a platform for a person to stand and operate manually via a steering wheel.

The intent is for customers to use this feature as little as possible.

“The economic costs of a manual driver of an industrial truck add up,” the Carnegie Mellon graduate says. “It’s not just the hourly rate. It’s a fully burdened rate. And turnover is enormous. Some customers have 300% turnover of material handling drivers.”

Jobs evolve, particularly during explosions of new technology, and lift truck operator seems to be on its way out. Christensen says it’s by their choice.

“They are leaving this sector and getting, frankly, a higher paying job doing something that is more interesting anyway,” he says.

This may be a big reason there are so many accidents.

“The replacement is a lower trained worker, which is exacerbating this problem,” he says. “You don’t want to have low skilled, high turnover jobs moving 5 tons of material around a factory. It’s a very dangerous job.”

Christensen believes it’s not the equipment, but it’s us who are the problem.

“People are the most dangerous component of an industrial vehicle, so that is what we are taking out of the equation,” he says. “We are particularly poor at repetitive tasks, we get bored, we get distracted and we make mistakes. If we’re pulling five tons and somebody makes a mistake, somebody gets hurt.”

One added bonus of automation is connecting to the Internet of Things. Seegrid uses its Supervisor software to create dashboard for managers to direct traffic in highly complex logistical operations, such as Amazon. That data not only helps track materials on the floor in real-time, but also allows for further optimization as you ramp up use.

“You’re not hitting numbers on day one,” he explains. “So you make tweaks as you go, watching the trend line and experiment based on the data you’re seeing.”

This allows for continuous improvement and can also point out flaws in other parts of the operation.

Christensen offers a hypothetical situation where a company is not hitting goals one route in the second shift because the carts keep arriving late. The supervisor can investigate what is different about that shift and finds an abnormal amount of obstructions slowing the machines down, indicating a 5S problem. That’s something that can be corrected, but would have been overlooked otherwise.

“There’s a lot of low hanging fruit on route and material flow optimization when studied frequently,” Christensen says. “You can solve 70-80% of problems this way. There’s a lot of value from having that visibility.”

The OMEGA Plan

Not far away the other mobile robots booths in the McCormick Place’s East Wing, a never-before-seen autonomous robot paces around in circles prior to its debut. It’s the OTTO Motors’ OMEGA: a first of its kind, a self-driving forklift.

“The best way to create a safer work environment, when many issues are caused by forklifts, is to remove them entirely,” says OTTO Motors CEO Matt Rendall.

The OMEGA is the gradual progression of this philosophy, being totally driven by software, but with a semi-autonomous mode for humans to steer from behind to take on complex tasks (for a robot), such as going up a ramp and into a tractor trailer.

Previously, the company founded by Rendall and partners from the University of Waterloo in Ontario, offered factories and warehouses the OTTO 100 and OTTO 1500, which operate like the low-profile lineup of MiR and the KMR1500.

Rendall says the OTTO 1500 has helped cut down on forklift use on the floor. The manually operated vehicles can be confined to shipping and receiving, relaying pallets to the smaller robot which scurries back to the production line to drop off or pick up more material.

“We think the combination of automation and quarantining is one of the safest possible strategies for our customers,” Rendall says.

The OMEGA, which was always the company’s target solution, allows for this transition and quarantining, and forklifts in general, to be excised.

Rendall explains that the OMEGA trucks could queue up near the shipping area, and one by one be manually navigated into the truck to load or unload goods. Then they could be steered back to the line and take off by themselves to complete a just-in-time or hot parts process.

The OMEGA will be available in 2020 and Rendall suggested that it could be hired monthly through a Mobility-as-a-Service approach.

With a few preferred customers testing on non-critical handling operations. That makes sense, as when you’re trying to replace industrial fixtures as big as forklifts, it’s best to play it slow and safe.

“We have a lot of assumptions, which we think are good assumptions, but we also don’t know what we don’t know,” Rendall says.

One thing we do know is that there is no turning back now. The age of the lumbering forklift, always capable of tipping over on or crushing unsuspecting or careless workers, will someday soon be a thing of the past, like the dinosaurs. And like mammals, these smaller, smarter creatures will fill the niches they left behind. In this case we didn’t need an asteroid, we only need the right value proposition.