Latest from Industry Trends

Jeffrey Immelt is stepping down as chairman and chief executive of General Electric Co., ending a 16-year tenure in which he dramatically reshaped one of the world’s top manufacturers yet struggled to win the approval of Wall Street.

John Flannery, a 30-year GE veteran who currently heads up the health-care business, will take over as CEO on Aug. 1, the Boston-based company said Monday in a statement. The 55-year-old will assume chairman duties following Immelt’s retirement on Dec. 31.

Immelt is leaving after months of stepped-up pressure from activist investor Trian Fund Management, which called on GE to improve performance and cut costs more aggressively as shares missed out on a broad stock rally. GE has dropped 12 percent this year through Friday, compared with an 8.6 percent gain for the Standard & Poor’s 500 Index.

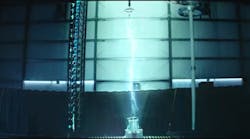

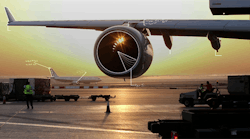

Immelt, 61, led several of GE’s largest-ever acquisitions, expanding the company’s focus on making jet engines, medical scanners and gas turbines through moves including the 2015 purchase of Alstom SA’s energy business. He has also withdrawn GE almost entirely from financial services, which once accounted for about half of the company’s sales.

GE shares rose 3.2 percent to $28.83 before regular trading in New York.

Trian didn’t immediately respond to a request for comment.

GE Veteran

Flannery, who was named the head of GE Healthcare in 2014 after handling M&A for GE, has boosted sales and profit margins in the division. The appointment is the result of succession planning that’s been under way since 2011, the company said. Flannery joined GE in 1987.

The CEO-designate “has led complex financial and industrial businesses all over the world, including running GE Healthcare, GE in India and the business development team for GE through the successful acquisition of Alstom,” Jack Brennan, the company’s lead independent director, said in the statement.

Immelt, who took the helm after Jack Welch retired in 2001, has become one of the world’s best-known CEOs yet never won the accolades that Wall Street bestowed upon his predecessor. The shares have fallen about 30 percent since Immelt took over as he faced criticism for cutting the dividend in 2009 and paying too much for some acquisitions. He also built up the oil and gas division just before crude prices plummeted.

Immelt won widespread praise in 2015 for a plan to sell the bulk of the volatile GE Capital business and closing the Alstom deal amid heavy political pressure in France. Trian, the firm co-founded by Nelson Peltz, took a $2.5 billion stake that year while saying it supported the portfolio shift.

The relationship with Trian began to sour in recent months as investors questioned GE’s performance. GE on Monday reaffirmed its 2017 outlook while omitting mention next year’s target of profit of $2 a share.

Kieran Murphy was named president and CEO of GE Healthcare, the company said in a separate statement. Jeff Bornstein, GE’s chief financial officer, was promoted to vice chair.