The term "secular stagnation," coined by economists in the 1930s and recently popularized by Larry Summers, has become a catch-all description for long-term economic pessimism. But it's gotten confused with a very different idea -- the technological stagnation hypothesis, proposed by economist Robert Gordon (and by Bloomberg View's Tyler Cowen). These are two very different ideas. Both would lead to slow growth in the long term, but they imply different causes and different remedies.

Summers' secular stagnation is all about aggregate demand. Normally, economists think of demand as something that falls temporarily into a recession and then bounces back. But the failure of many economies to return to their previous trends after big slowdowns have made some economists worry that demand shortfalls could be very persistent.

Concept of Secular Stagnation:

Economies of the industrial world, in this view, suffer from an imbalance resulting from an increasing propensity to save and a decreasing propensity to invest. The result is that excessive saving acts as a drag on demand, reducing growth and inflation, and the imbalance between savings and investment pulls down real interest rates. -- Larry Summers, former U.S. Secretary of the Treasury and Chief Economist of the World Bank

Demand gaps usually emerge when everyone tries to save money at the same time. This could happen because people become more pessimistic about the future, for example, or because they suddenly decide they need more liquid assets. But when everyone tries to hold onto cash, they don't spend, and so companies don't produce things. Companies that don't produce things lay off workers, and pretty soon there's a recession.

Usually, this process ends naturally. Eventually, people need to replace their old cars and fix up their houses, or their temporary bout of pessimism ends, or some other force acts to restore demand. But under certain conditions, in some models, it's possible for an economy to trap itself, so that low demand and slow growth become a self-reinforcing, self-perpetuating cycle.

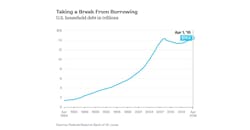

One model that gives this result comes from a 2014 paper by economists Gauti Eggertsson and Neil Mehrotra. The source of the negative demand shock comes from people's attempt to deleverage after a big increase in private debt. That simultaneous deleveraging pushes down interest rates until they hit zero and can go no further. With interest rates unable to go below zero, economic activity slows down, meaning people can never pay off their debts. But they keep trying, and their continued attempts to do so keep the economy in its atrophied state.

That's an intuitively appealing explanation for what rich countries are going through now. There has obviously been some deleveraging since the financial crisis, but it seems to have stopped:

Meanwhile, interest rates have been stuck at zero, and gross domestic product never rebounded to its pre-crisis trend. This is pretty much what happened to Japan after its bubble burst in the early 1990s. Eggertsson's explanation of secular stagnation is appealing because it directly connects financial crises and debt overhangs to low growth and low-interest rates—all things we've seen in real life.

Technological stagnation is a different beast. According to Gordon and others, humanity has simply picked most of the low-hanging fruit of science and technology. Airplanes and cars travel no faster today than they did 50 years ago. Electricity, air conditioning, and household appliances have made our homes about as pleasant as they're likely to get, and so on. That doesn’t mean advances stop, but it means that each one is less game-changing than the last.

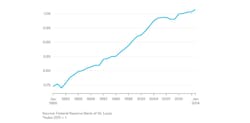

A key piece of the tech stagnation hypothesis is that the production of the things we want isn't going to get much cheaper. Gordon points to slowing productivity as evidence that our economy is getting worse at finding new ways to do more with less:

This trend is worldwide, which makes sense since a decline in science and technology should be global in nature.

So technological stagnation is all about supply, while secular stagnation is about demand. The two are related—slower productivity growth tends to reduce interest rates, putting the economy closer to the zero lower bound that drives demand shortages in Eggertsson’s model. But the two types of stagnation are very different things, requiring very different policy responses.

If we’re in secular stagnation, the economy is wasting its potential. Workers are staying home—not counted as officially unemployed, but out of the labor force completely—playing video games while offices sit empty and unused. In that case, we need something like fiscal stimulus to raise demand and lift us back to full employment.

But if we’re in technological stagnation, there’s not much we can do. Yes, there are some things government can do to boost innovation at the margin, like reforming patent laws, lifting onerous regulations, and investing in research and development. But in the long term, the forces of progress are difficult to predict and control. If we’ve already exploited the biggest innovations, we need to reconcile ourselves to living lives not much better than those of our parents. That would be a disappointing outcome, but it might be the best we can do.

Noah Smith is a Bloomberg View columnist. He was an assistant professor of finance at Stony Brook University, and he blogs at Noahpinion.