Steel long products, including bar, rod and wire products, account for about 20 to 25% by weight of the steel used in North American light and heavy vehicles based on information provided in a 2010 Mega Associates study.1 Of this total, more than 85% are parts sourced from hot-rolled bar products. Parts made from steel bars represent 400-500 lbs. of an average North American vehicle, and this quantity has remained consistent despite automotive OEMs’ ongoing lightweighting programs. The steel bars are manufactured into a wide variety of vehicle components, many of which are forged components, including: gears, connecting rods, crankshafts, injector systems, camshafts, hubs, bearings, transmission shafting, steering racks, steering linkages, stabilizer bars, constant velocity (CV) joints, drive axles, suspension springs, and more.

North American steel bar producers provide a wide range of steel grades with unique chemistries and properties. In addition, metallurgical processes such as heat treating, thermo-mechanical rolling, hot and cold working, and surface hardening, enable diverse properties in these products. These processes impart a wide range of new properties from a very ductile, formable structure to a high-strength product with excellent fatigue properties.

This wide scope of mechanical properties and the fact that steel bar production is a proven, high-volume manufacturing process bodes well for the future of these products’ suppliers, when considering steel as the material of choice for demanding automotive part applications.

Steel Industry Trends/Challenges

The automotive industry is striving to reduce vehicle mass in an affordable way, to improve fuel efficiency while maintaining or improving safety and performance. In order for them to move in this direction there is a need to create more power-dense steel products. Power density is defined by the ability to carry increased load with the same size component, or the same load using a smaller-sized component, or a combination of these.

As vehicles are downsized, automotive companies will seek to optimize component weight by looking for cost-effective ways to reduce part weight, modify the design of the part, or consider other lightweight materials. When deciding on the best lightweighting strategy, it is important to consider all the factors involved in evaluating a vehicle, such as performance (strength and durability), vehicle safety, life-cycle environmental impacts, and the value of the lightweighting approach.

Steel is a proven, high-performance product, is 100% recyclable, and has the ability to be hot forged, cold formed, machined, and extruded into a variety of part configurations. Steel solutions using these manufacturing processes offer high value to the customer, as there are opportunities to optimize manufacturing costs and part performance.

Application opportunities

Manufacturing processes represent a significant portion of the cost of vehicles’ component parts. For example, forming, heat treating and machining can account for as much as 75% of the part cost. Therefore, it is important for the steel industry to work closely with all participants in the manufacturing supply chain, to deliver components that meet performance, weight, environmental, and value requirements.

The Long Products Market Development Group (LPMDG) is a consortium of steel manufacturers and their customers and is part of the Steel Market Development Institute, a business unit of the American Iron and Steel Institute. This collaborative group has updated its Automotive Roadmap which identifies technical challenges and research opportunities in steel bar product metallurgy, enabling processes, steel characterization, and part design. A summary of this roadmap outlines the opportunities for bar steel in various applications, material development and manufacturing technology, to support the continuing need for improved performance and lightweighting in the automotive industry.

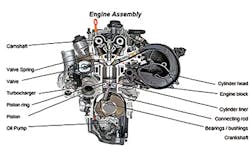

Engines — Automotive engines offer the greatest opportunity for improved fuel economy through mass reduction and increased efficiency. As internal combustion engines become smaller and generate more power, this will result in increased loads and stresses. This increase in power density for these components creates large potential for more forged steel components. Higher-strength steel components such as crankshafts, connecting rods, camshafts and pistons as shown in Figure 1 will be needed.

Figure 1. An internal combustion engine

with key components (highlighted in red)

where steel is currently used and likely to

remain as engine size decreases and power

requirements increases.

In addition to opportunities in engine applications, there are many other components of the powertrain system, along with chassis and suspension systems, where increased power-density in bar products will support weight reduction at equal or better performance.

Drivetrain systems — The drivetrain generally describes the components delivering power from the engine to the wheels, which includes the transmission, driveshaft, differentials, and axles. Most of the parts used to produce these components are sourced from steel bars, which are manufactured into shafts, bearings, and gears.

Steering systems — The steering system is an essential part of a vehicle and consists of several critical linkages and components that connect the movements of the steering wheel to the front wheels of the vehicle. These components consist mainly of the rack-and-pinion steering, the steering knuckle, control arms, and tie rods.

Figure 2. A rolling chassis with critical components (highlighted in red) where

steel is used currently, and likely to remain.

Chassis and suspension system — The automobile chassis and suspension system’s main function is to isolate passengers and cargo from dynamic reactions of the vehicle as it travels the road surface. Above all else, safety and durability control suspension design and material choices. The system consists of vehicle structural support components, including the suspension springs, strut rods, and stabilizer bars, as illustrated in Figure 2.

Material development

There also are improvements in other material characteristics of steel, such as fatigue and toughness, which can support improvements in power density.

Gear steels with bending and pitting fatigue resistance — Gear manufacturers and users are continually seeking improvements in material performance, in order to increase the power density of individual components and associated systems. For example, automotive transmission manufacturers would like to double the torque capability over the 10-year life of a given transmission. Improvements to the resistance to both bending and pitting fatigue properties of steel grades are needed to meet these and other similar goals for higher performing gear in various market sectors.

As-forged higher strength steels with high toughness — Hot-forged, air-cooled micro-alloy steel forgings meet the strength and fatigue properties equivalent to heat-treated parts. Micro-alloying precipitation strengthening technology has the potential to provide forged components with increased mechanical properties, to allow part lightweighting without the need to heat-treat the forging. A significant benefit of this technology is a lower part-manufacturing cost resulting from eliminating heat treating.

However, these micro-alloyed steels are not used to their full-strength potential, as their toughness tends to be lower than acceptable for a similar chemistry, heat-treated steel part. The development of as-forged steels with a higher level or improved balance of toughness and strength would expand the application of as-forged steels.

Manufacturing technology opportunities

All cold, warm, and hot forming operations have the advantage over castings and machined bar stock in controlling the deformation and metal flow to increase metallurgical soundness and improve mechanical properties. This can improve directional grain flow (anisotropy) where needed for maximum part strength, and provide better fatigue resistance and impact toughness on part sections, such as gear teeth. Additional research and development opportunities to improve forming technology and costs include:

Cold forging research and development focus

• Upgrade simulation software to predict breakage or lubrication failure;

• Develop test method to evaluate effectiveness of lubrication prior to part production;

• Create additional test method to evaluate formability prior to running production parts (cold upset test is satisfactory for certain applications); and,

• Further enhance deep rolling to apply its strengthening benefits to other components.

Warm forging research and development needs

• Improve die coatings and lubricants to better facilitate extrusion at higher temperatures; and,

• Develop warm temperature steel property data to improve computer simulation.

Hot forging research and development focus

Optimize reheating processes to allow better temperature control and avoid grain coarsening;

• Develop scale-free reheating;

• Improve die coatings for high forging temperatures;

• Enhance modeling of non-uniform cross-sectional heating on metal flow, especially in automated multi-sequenced forging;

• Create a vision system to monitor part-size tolerances and surface defects at high forging temperatures and high production rates.

Other manufacturing technologies

In addition, for improvement in forming processes to help meet automakers’ needs, there are manufacturing improvement opportunities, including:

• Improve machinability to reduce manufacturing costs related to forged components;

• Develop more competitive near-net shape forging operations to reduce the amount of metal removal during machining;

• Use enabling processes, such as surface hardening or coatings. to improve fatigue strength and resistance to surface wear on moving components; and

• Enhance fillet strengthening techniques to allow for higher strength levels in this fatigue-sensitive location.

The LPMDG Automotive Roadmap identifies numerous current technical challenges and research opportunities in steel bar product metallurgy, enabling processes, steel characterization and part design. The LPMDG uses this roadmap to define projects and has found working in collaboration with OEMs, Tier 1 and 2 customers offers the best opportunity to meet the automotive industry performance, fuel efficiency and value required for future applications.

David W. Anderson is the senior director of the automotive market and long products program at the Steel Market Development Institute. Contact him at [email protected], or learn more about the LPMDG Automotive Roadmap at www.autosteel.org