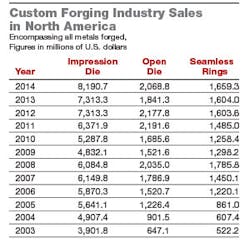

The Forging Industry Association released the figures documenting its U.S., Canadian, and Mexican members’ total 2014 shipments, revealing some notable gains in delivery volumes and new orders for producers in each of the three major product categories — impression-die forgings, open-die forgings, and seamless rolled rings. Total 2014 shipments reported by FIA rose 10.8% in value from 2013, to $11,918.8 million. It is the highest value for forged products shipments recorded in the past decade.

The FIA report is based on information collected from forging producers believed to have produced an average of 89% of 2014’s total custom forging sales. The report is statistically treated to represent 100% of industry shipments in the custom forging industry. (The results do not include forgings produced for “captive use” or standard catalog products. Cold-forged parts also are not included in the FIA report.)

The positive results were anticipated in the 2015 FORGING Business Outlook Survey, the end-of-year market analysis and forecast conducted during October 2014, from which we reported forgers’ documentable conclusion that 2014 shipments would show a solid improvement over the year-earlier totals.

In that earlier survey, more than 60% of all respondents advised that yearly shipment totals would increase. Among that segment of the respondents, 19.4% indicated shipment totals would improve in the range of 2-9% over the previous year; 44% reported the improvement would be in the 10-15% range; 25% predicted a 20-35% improvement; and 2.78% expected an improvement of 50% over the previous year’s results.

Custom Impression Die Forgings — FIA reported total shipments for the custom impression-die forging industry increased 12% in 2014 to $8,190.7 million, from $7,313.3 million in 2013. Impression die forgings are widely used in high-volume manufacturing sectors, and new orders during the past year rose to $7,230.5, or 1.5% above the 2013 result.

Automotive buyers (passenger cars, light trucks, SUVs, and component parts for those vehicles) represented the largest portion of the new orders for impression-die forgings last year, 30.0% of all new orders, followed by the commercial aerospace sector, which had a 20.9% market share in 2014.

Custom Open-Die Forgings — FIA reported total shipments by custom open-die forgers rose 12.35% in 2014, up to $2,068.8 from $1,778.4 reported for 2013.

Open-die forging relies heavily on energy and defense market demand, and conditions while conditions in those markets continue to be challenging, new orders for open-die forgings increased 20% to $2,141.8 05, compared to $1,778.4 for 2013.

Oil-and-gas exploration machinery and equipment held the top spot among open-die forging market segments, with 30.3% market share. Defense markets (including military aerospace, military heavy vehicles, ordnance/guided missiles, and naval nuclear applications had a13.7% marketshare in 2014, for the second ranked spot.

Custom Seamless Rolled Rings — FIA reported total shipments of seamless rolled ring forgings increased 3.45% in 2014, up to $1,659.3 million from $1,604.0 million for the previous year.

New orders for seamless rolled rings increased 6% for 2014, up to $1,689.1 million. Commercial aerospace manufacturers remained the largest segment for rolled-ring demand, 45.4% of the total market share during in 2014. Oil-and-gas field exploration machinery and equipment held the second place, again, with a 13.3% share.