Equipment Finance Industry Sees Increased Confidence in January Survey Results

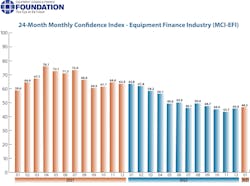

The Equipment Leasing & Finance Foundation has released the January 2023 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI), which reports on the qualitative assessment of prevailing business conditions and expectations for the future, as reported by key executives from the $1 trillion equipment finance sector. The overall MCI-EFI for January 2023 is 48.5, which represents an increase from the December index of 45.9.

Looking ahead, none of the executives responding to the survey believe that business conditions will improve over the next four months, but 69.2% believe that conditions will remain the same, which is up from 55.6% in the previous month. Additionally, 30.8% believe that conditions will worsen, which is a decrease from 40.7% in December.

None of the survey respondents expect demand for leases and loans to fund capital expenditures to increase over the next four months, but 88.5% believe that demand will remain the same, which is an increase from 70.4% in December. 11.5% believe demand will decline, which is down from 22.2% in the previous month.

Regarding access to capital to fund equipment acquisitions, 11.5% of respondents expect more access over the next four months, down from 14.8% in December, and 73.1% of executives indicate they expect the same level of access, which is an increase from 70.4% in the previous month. However, 15.4% expect less access to capital, up from 14.8% in December.

“2023 brings uncertainty with a looming recession in front of us, yet robust volume and credit quality continue to be our experience."

When asked about hiring, 38.5% of executives report that they expect to hire more employees over the next four months, up from 33.3% in December, and 61.5% expect no change in headcount, which is an increase from 51.9% in the previous month. None of the respondents expect to hire fewer employees, down from 14.8% in December.

In terms of the current state of the U.S. economy, none of the executives rate it as excellent, down from 3.7% in December. 84.6% of the respondents rate it as fair, up from 70.4% in the previous month, and 15.4% rate it as poor, which is a decrease from 25.9% in December.

Looking ahead, 7.7% of the respondents believe that U.S. economic conditions will get better over the next six months, an increase from none in December. Additionally, 57.7% believe that the U.S. economy will stay the same over the next six months, an increase from 48.2% in the previous month, and 34.6% believe that economic conditions in the U.S. will worsen over the next six months, a decrease from 51.9% in December.

Finally, 23.1% of respondents indicate that they believe their company will increase spending on business development activities during the next six months, down from 37% in December. 73.1% believe there will be no change in business development spending, up from 59.3% in December, and 3.9% believe there will be a decrease in spending, which is unchanged from last month.

When asked about the outlook for the future, MCI-EFI survey respondent David Normandin, President and Chief Executive Officer, Wintrust Specialty Finance, said, “2023 brings uncertainty with a looming recession in front of us, yet robust volume and credit quality continue to be our experience. Being nimble and creative to find solutions will be valuable attributes to have in your organization as we stretch our legs into 2023. Fortunately, this is where the commercial equipment finance industry has excelled and I believe it will once again.”

About the Author

Laura Davis

Editor-in-Chief, New Equipment Digest

Laura Davis is the editor in chief of New Equipment Digest (NED), a brand part of the Manufacturing Group at EndeavorB2B. NED covers all products, equipment, solutions, and technology related to the broad scope of manufacturing, from mops and buckets to robots and automation. Laura has been a manufacturing product writer for eight years, knowledgeable about the ins and outs of the industry, along with what readers are looking for when wanting to learn about the latest products on the market.